Otoy Co-Founders Jules Urbach and Alissa Grainger have just launched Render Token, a whole new concept in massively scalable, off site rendering. While the market for this might initially seem like film or entertainment, the company is setting up the system to appeal to manufacturing, medical, gaming as well as AR, VR and anything else that has a high quality complex rendering requirement.

The Render Token network is different from what has proceeded it as it is not offering ‘cloud based rendering’ where there are virtual PC machines running standard industry software on say Amazon’s AWS. The Render Token is offering to build a decentralised cloud that offers users both rendering outputs and the ability to earn ‘money’ doing the rendering.

The Render Token aims to make the process of rendering streaming photorealistic simulations and services easy and accessible to a wide audience, by providing an easy way to both buy rendering and also ‘sell’ spare rendering or GPU time you might have put back into the system. It should allow complex GPU-based render jobs to be distributed and processed on a new special peer-to-peer network. The system uses blockchain technology to help manage this under the hood. In particular the Ethereum network, which is robust and already well established. The blockchain is hidden from artist’s sight: you will be able to use the system securely and with indisputable digital rights management without having to know anything at all about blockchain.

But as this system is built on trust, in this article we have broken down all the elements so you can deep dive into the logic of the whole system if you wish to.

How it works

At the simplest level, you buy rendering or sell computer time. The system manages your account. All content is converted via the Otoy ORBX into a state able to be rendered in the system. This has solved the problem of having all the different renderers on the system. The ORBX interchange format supports not only all the normal applications such as 3dsMax, Maya, etc, but also a host of complex streaming holographic media types (8D light field + depth) and interactive formats. Once in the ORBX format imagery can be rendered on the OctaneRender, a fast GPU-accelerated, unbiased, and physically correct renderer.

The use of a Blockchain is essential for resolving and storing permanent state changes in shared 3D scenes, for which time-stamped proof of authorship and re-composition rights are needed.

How much does it cost? What are the margins like?

If one can both use the system and also render for the system, then the question becomes what is the clip or markup that the service takes? If I render for 100 units, how much rendering can I later buy, (clearly the company has to make some money – it needs to have some profit margin)?

Kalin Stoyanchev, Otoy’s blockchain expert and project lead on The Render Token, explains that “the user keeps 99.5% of all tokens for rendering, so our network fee is very small and covers the transaction and interaction with the Ethereum Network to process your job. You do not have to pay the network Gas to cover your transaction.” -(See below at the end of the article). The Render Token Network handles and covers the transaction fee for the end user, otherwise users would need to buy Ether and deal with the complexity of the Blockchain. The whole blockchain aspect and payment system is invisible to users and all the Ethereum financials are handled for the user. “We want to make sure the system works, there are other systems that take 5% or even 10% and it leaves people really wondering…our main goal is to maintain a robust rendering marketplace and a robust eco-system. We want people to know that their GPUs are valuable and that they are going to get 995 parts per 1000 for everything that they do” he adds.

When?

Otoy is backed by companies such as HBO. Otoy is putting the Render Tokens on sale on Thursday, October 5th, 2017. The company is looking to raise as much as $134 million with a 537 million tokens to kick-start the project. The initial tokens are not discounted.

Joining the network to start earning tokens is on the road map as happening in Q1 of 2018. “It will be a super easy, super polished user interface that allows people to go in and say I have spare GPUs, people can render with them, I connect to the network and boom – you are earning tokens – super easy”. explains Stoyanchev. Having earnt tokens you will be able to convert them to Ethereum Ether – which can the be exchanged for any currency or any goods that people will sell using the Ether currency directly.

Background

RenderToken is from the team at OTOY, which was founded in 2009. When founder and CEO Jules Urbach started OTOY eight years ago, he had already envisioned a future where anyone could have an easy pathway to cloud-based, rendering. In 2009, Urbach patented his idea for a “token-based billing model for server-side rendering”, this was several years before tokens and blockchain technology were widely in use, but he actually first started experimenting with the idea in 2004. “When I was starting out I was doing GPU raytracing, directX and I was playing around with these ideas on really early GPU hardware in about 2006”, he comments. “It wasn’t until Amazon really launched g2 (EC2 2013), that it really started to take form”. In 2013 Amazon launched a new type of service for its EC2 cloud computing platform that is specifically designed for applications that require 3D graphics capabilities. It allowed companies like Otoy to build high-performance DirectX, OpenGL, CUDA, and OpenCL applications without making expensive up-front capital investments. The g2 supported OTOY’s ORBX on the GPU instances.

The ORBX downloadable codec was written in JavaScript and WebGL and it allowed people to stream 3D-intensive applications right from the cloud without the need for any plug-ins, codecs or other client-side software except for the actual Mozilla web browser. The project was backed by Mozilla, Autodesk and OTOY. At that time OTOY also demonstrated apps like Photoshop CS6 and games from Valve running in the browser using ORBX. OTOY immediately published a number of ORBX enabled machine images for EC2, including one for Autodesk’s 3D applications.

The new idea is to have a decentralised cloud that allows “you to buy render chunks in five dollar increments”, explains Urbach. “And in those $5 increments you have a certain amount of OctaneBench which is a way of defining energy or units of work” (OctaneBench allows users to benchmark their GPU using the OctaneRender. This provides a level playing field by making sure that everybody is talking about the same level of power and settings. These are universal units of work (or GPU rendering) no matter what GPU one actually has). These units of rendering are bought using tokens . These tokens are small, they are worth about 25 cents and they buy about four minutes of rendering at 256 OctaneBench level – which is higher than any current normal GPU card, and Urbach expects this rate will improve strongly over time and be even more cost effective.

ORBX

The ORBX system allows you to take a snapshot of your work and convert it to a render format for Render Token rendering. This means if you are using Cinema4D, you do not need Cinema4D to be on the Render Token network. It does this by converting everything to a common render description using ORBX. “Today that is how we already support cloud rendering”, explains Urbach, referring to the current Amazon AWS more traditional cloud rendering option that Otoy offers.

“Over the years, we have worked really hard to decouple the rendering work with all the different implementations (bridges), there are now around 25 or 26, with Unity being the latest one”, explains Urbach. “We can take a snapshot of the scene and we don’t have to have C4D, AfterEffects, or any of these things on the rendering nodes, which is key. It allows us to send render jobs to the network and not worry about plugins or running virtual machines, thus the cost of the rendering is much more efficient”. This system means that the RenderToken network does not have the cost of supporting a huge array of software licenses, so overheads are at a minimum. For example the team notes that Cinema4D is about 10 Gigabytes when fully installed, it would be unworkable if every user processing a Cinema4D job to have that downloaded and installed on their computer. With Octane and ORBX there is just one piece of software doing the work for whatever source application users have in any industry or end use application.

At the core of a ORBX file is a simple virtual disk system and a single high level XML file representing a root render graph to be evaluated, with optional inputs (eg. camera view, projection and position) and at least one output. (usually a render target).

The XML render graph schema in ORBX is a valid PBR node system, with all asset dependencies accounted for, in a form that can be evaluated. The system handles cache data and simulation work, and is at the core of the normal (AWS style) ‘cloud’ rendering option Otoy has been offering for some time. For example, the opening credits of Westworld were rendered on the Otoy cloud which is serviced by ORBX. But up until now rendering using ORBX was rendered on a commercial computer ‘cloud’ farm such as Amazon’s AWS.

ORBX is based on the book Physically Based Rendering: From Theory to Implementation, for which Matt Pharr, Greg Humphreys, and Pat Hanrahan were awarded a 2014 Academy Award for Scientific and Technical Achievement. (The Academy called the book a “widely adopted practical roadmap for most physically based shading and lighting systems used in film production”).

A secondary goal of ORBX, besides providing a source description for rendering a scene procedurally, vs from geometry or voxelized buffers, is to serve as a target for computational photography. ORBX is the target format for all 8D reflectance field captures performed by OTOY’s own Light Stage service. It has always been designed to be more than just a simple render format, making it well placed for streaming VR/AR and other much more complex and new Lightfield type rendering applications. For example, the system can handle UHD 8K@240 fps which is over 256 x as complex as standard TV work at HD 720p30P.

The ORBX system, at times, needs to bake things for rendering which can increase the size of the files, but “that is something that we have been working towards improving,” says Urbach. “We are working at procedural exporting. We just got Open Shader Language working, that will be in the next version, FBX will also be included so bone and skinning support for things that are deformable, you won’t need to bake them into Alembic, and that will already make much of the source assets much smaller and portable.”

The ORBX system also uses the hash system of the blockchain so each job has a unique fingerprint for security and safety. The system is also efficient, as it looks inside the scene graph for any alembic files or caches that are already on the system, and thus does not resend the data. Combined, these two features opens up the world to Render Token vectors that allow assets to be sold or rented. As each thing has a unique code, it could aid in massive asset sharing/sales and be reused across the network. One could imagine a day where a VR project uses a range of assets and every single artist who contributed to that final render is paid in fractional Render Tokens. “You could even put ads on the surfaces of objects – so you could monetize that way … it is like a basis function for scene transformations… it is so powerful, there is no limits to publishing. It just needs to be expressible in this screen graph node model,” says Urbach, pointing to how the ORBX system has been modularly designed for commerce and transactional pieces from the beginning.

While Octane is the only way to render now in the Render Token, Urbach very much expects that over time other renderers and special applications will use the SDK to also sit on top of the Render Token system.

But how do you know you are getting what you pay for?

There are two concepts to be understood: the Ethereum concept of ‘Proof of work’ and an additionally the domain specific ‘Proof of Render”. Ethereum’s smart contracts show the work has been done and that it is recorded. On top of this, the Render Token has a built in way of making sure that the job you paid for is what you actually got. For example without this second layer of “Proof of Render” notionally someone could render half res and upres and deliver files that were much easier to render but inferior, even though the final output is within spec (ie. at the right resolution).

Thumbnails are provided to users with a watermark, so people can check their work before the payment is made. This means if there is a bad render – say frames of black, the user can flag these before their account is debited. Once you validate the render, the unwatermarked version is unlocked, payment is made (Render Tokens exchanged) and the client who did the rendering gets reputation points that builds their profile as a good site for delivering rendering.

To help the system has an AI engine which validates before you see your work that nothing has been created, it detects upresing and other denoising short cuts. Of course Denoising is a very valid aspect that many people use on ray tracing, but applied excessively, beyond what was requested, is often best found by an AI ‘check bot’ rather than just by inspection by the user.

Blockchain

It is significant that the Otoy rendering solution may very well attract members from the Blockchain mining community, who have previously not been involved with graphics or renderings ever before.

The Token’s that users can earn rendering are really Ethereum ‘tokens’. “This means people outside the normal rendering business / Octane users have a way to switch from using their resources to mine cryptocurrency and redirect this effort to performing render jobs”, explains Urbach. “I have never seen anyone in this space focus on meaningful work before, when you are focusing on mining cryptocurrency you are just basically ‘hashing’ numbers – it is like spinning a lock until you get the right combination, once you do, there is a reward in the form of money in the exchanges but it hasn’t actually done anything or meant anything” he explains. Furthermore, it becomes more expensive everyday as currency is unlocked, the work gets harder – that’s how it works. “But with a render job, as long as we are equivalent to the reward you’d get from Ethereum, the effort miners are currently using could be applied to rendering work, and you don’t even need to in anyway be connected to the rendering world of artists and users – just apply your mining GPUs to rendering and be rewarded” he adds.

RenderToken’s uses a particular individual blockchain : Ethereum. For the most part, this blockchain works very much like the orginal Blockchain that is linked to bitcoins. It is important point to understand, bitcoins and blockchain are not the same things, the words are not interchangeable.

Ethereum is to build to be a safe, unstoppable, censorship-resistant, self-sustaining, decentralised world ledger and computer that can perform calculations, store data, and allow communications. Anyone who runs the Ethereum software on their computer is participating in the operations of this world-computer, known as the Ethereum Virtual Machine (EVM). Because the EVM was designed to be Turing-complete(ignoring gas limits * see the end of the article), it can do almost anything that can be expressed in a computer program.

Bitcoin and the original Blockchain explained

Almost everyone in the film, games and tech industries has heard the claim that blockchain will revolutionize business and redefine companies and economies, but for the system to work, there needs to be trust, and for trust it is helpful to understand how a system works, at least in simple terms.

Blockchain, as in the original peer-to-peer network ledger system, was introduced in October 2008 as part of a proposal for bitcoin by the unknown and mysterious Satoshi Nakamoto. Bitcoin is a virtual currency system that avoids a central bank or nation state for issuing currency, transferring ownership, and confirming transactions. Bitcoin was the first application of blockchain technology.

In October 2008, Nakamoto published a paper on The Cryptography Mailing list describing the digital currency. It was titled Bitcoin: A Peer-to-Peer Electronic Cash System. In 2009, Nakamoto released the first bitcoin software and the first units of the bitcoin cryptocurrency.

Bitcoin’s first commercial use was to buy two pizzas — for the princely sum of 10,000 Bitcoins, which today makes that Pizza worth US$32,640,000 ! ! ! (1 bitcoin today = US$3,364 down from a recent US$5000).

What makes an $A or Mexican Peso worth something? Back in history, as we were all taught in high school, there was the gold standard and thus paper money was backed up with equivalent of real gold that was actually tangible (see Fort Knox, and the Gold Standard’s end in the early 1970s). Back then you could theoretically convert US$ for its value in real gold ($35 = an ounce of gold in ’71). But with the loss of the gold standard the only thing that makes us trust money is that… we trust money. If someone just prints more currency, we trust it less and we devalue the currency (see the Argentine Peso in the 80s). If the government issuing their ‘money’ is in financial trouble then their currency is worth less compared to others. If we think Great Britain is a solid financially sound country, then we all like the British Pound, but when the UK said it was leaving the EU we ‘trusted’ it less and the pound was devalued. All ‘value’ of paper money is artificial in a sense. We just all agree to use(trust) our money and the system is stable enough that it works.

Bitcoin was introduced to be a stable currency but one not issued by a country. For bitcoin to work there had to be a finite amount of bitcoins (you could not just invent a ton more over the weekend or trust evaporates) and people just have to use it and trust it. But without an issuing Country with a central bank how do you put the bitcoins out there? After all, while you don’t want arbitrary amounts of money invented by someone randomly, you do have to slowly release currency so people can use it.

The answer is a mathematical formula was developed to release the bitcoins. Solve some maths and bitcoins are slowly released, but the more bitcoins that are released, the harder the maths problem is to solve. If all you need is a computer to ‘make money’ then the maths problem better be pretty hard or everyone will solve it and earn or ‘mine’ bitcoins. Today specialist computer farms with dedicated PCs are set up to mine the ever harder to solve/find bitcoins.

What is a bitcoin worth? Something is worth whatever someone is willing to pay for it. In the early days you could exchange a bitcoin for just a few dollars. The idea was novel and perhaps unstable – so people would not risk much US$ in exchange for a bitcoin. But as the currency was accepted more widely, the value or exchange rate skyrocket.

Mining is just number crunching formulas to reach the next stage, but the actual computer time produces no useful output, goods or services, it just ‘spins dials’ until the computer finds the next combination, and once that coin is found, the computer just starts spinning dials again. There is nothing made during the mining for the next coin, nothing of value.

The underlying blockchain technology is really a very clever way of storing who owns what bitcoins in a way that no one person or group controls. The record or ledger of who owns what coins is stored in a distributed way that means no one can really cheat and everyone can (if need be) validate who owns what. You no longer need a central bank, or any traditional bank, the community itself maintains the ledger.

What has this to do with Rendering?

Well it turns out that the two factors in deciding if you want to mine a cryptocurrency:

a) how hard is it to mine

b) how valuable a currency is.

Today, one has to build special ACIS computer chips to compute fast enough to stand any chance of getting some of the remaining bitcoins. As it stands, if the bitcoin value dropped a massive amount, and stayed low, then the cost of mining would perhaps just not be worth it. The computer gear and the electricity to run it, would not make it profitable. It is similar to mining iron ore. If the Iron ore market price plummets, it is not profitable to mine. The difference here is that the Iron ore mine can only mine Iron ore. A bitcoin computer farm could conceivably become a renderfarm. It could stop mining coins directly and just get paid for rendering instead.

Otoy does not use Bitcoin or the original Blockchain, it uses a very similar but newer blockchain called Ethereum, and the coins are not called bitcoins they are called ether, but the principle is the same.

And just with currency, it is important that people involved in rendering have a foolproof way to record who did what, and that no one can steal your valuable Render Tokens.

Ethereum

Ethereum is a digital currency invented in 2013, 4 years after the release of Bitcoin. It has since grown to be the second largest digital currency in the world by market cap ( $20 billion, compared to Bitcoin’s $40 billion). Like all cryptocurrencies, Ethereum is a descendant of the Bitcoin protocol, but it have improved on Bitcoin’s original design by adding some smarts to the ‘ledger’.

Above we stated that there is a distributed ledger. This is not to say the ledger in the ‘cloud’. It literally means there are many of copies of the ledger – all the same and all validated to be in sync. It is a remarkable technological trick.

If BlockChain is just a safe distributed ledger, Ethereum is a distributed ledger plus some computations. These additional small computer programs are called ‘smart contracts’, and the contracts are run by using a sort of operating system called the “Ethereum Virtual Machine” or EVM.

- The Ledger (Blockchain or Ethereum)

Here is how it works.

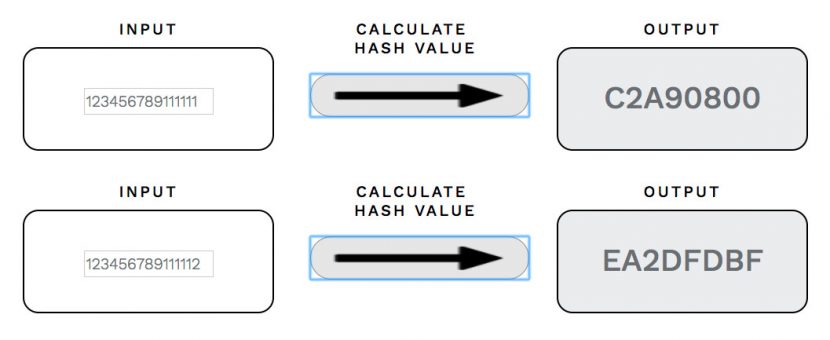

Tthink of all the data as blocks – and they are linked together in order. The ledger is secure as it uses very clever cryptography. Each block contains a pointer to the previous block. Once recorded, the data in any given block cannot be altered retroactively without the alteration of all subsequent blocks. The pointer is actually a hash value.

A hash value is a numeric ‘value’ or ‘code’ of a fixed length that uniquely identifies data. The hash is calculated by taking the index, previous block hash, timestamp, block data, and data all as input.

For example, if a hash value is say 32 characters long, then if one provides it anything, of any length, you get a 32 character long string back. Give it your PhD thesis or your shopping list and you get back a unique 32 character string. Change one letter in the PhD thesis or say one digit in the shopping list and you get an entirely new and completely different looking hash output. Furthermore, as it is always has 32 character, one can’t tell by looking at it if the source was 250 pages of thesis or a half a page shopping list.

Blockchains have the word ‘chain’ in them as a chain of hash pointers is used. While Bitcoin uses its blockchain to implement a ledger of monetary transactions, Ethereum uses its blockchain to record state transitions in a gigantic distributed computer.

Ethereum’s corresponding digital currency, ether, is essentially a side effect of powering this massive computer. Ether and Bitcoins are very similar, they are both the currency of each system and both use blockchains under the hood to keep track, but Ethereum’s blockchain has the added ‘smart contracts.

2) Smart contracts (Ethereum only)

Smart contracts are simply computer programs that run on the EVM. In many ways, they are like normal contracts, except they don’t need lawyers or judges to interpret them or validate them. Instead, they are interpreted unambiguously by the EVM. Think of Smart Contracts as being at the level of Excel spreadsheet Marcos. With these programs, one can (among other things) programmatically transfer digital currency based solely on the rules of the contract code.

Of course, there are things real world contracts do that smart contracts can’t — smart contracts can’t easily interact with things that aren’t on the blockchain. But smart contracts can also do things that normal contracts can’t, such as enforce a set of rules entirely through unbreakable cryptography. This leads us to the notion of wallets. In the world of digital currencies, wallets are how you store your assets. You gain access to your wallet using essentially a secret password, also known as your private key.

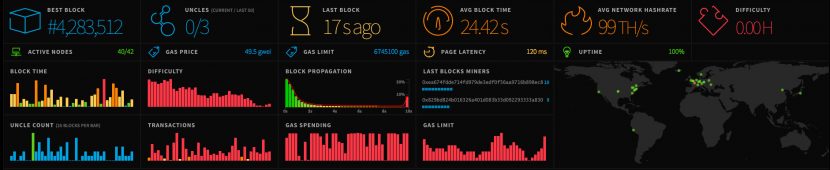

Does it scale?

All of this begs the question, if everything in Ethereum is put into this one ledger, and the ledger is a record of all transactions, then just how big is this ledger?

The answer is the ledger is getting big and getting bigger. As a user of the Otoy Render Token you never have to care, but that being said, the problem of Blockchain bloat is an issue. There is just one Ethereum Blockchain ledger, the Render Token data from the Otoy system will all go into that one decentralised but singular ledger. At the moment, the Ethereum size is less than that of Blockchain, but it is still about 70 Gigabytes. That means that each of the miners who validate the ledger, has to download it, but you as a Render user don’t.

As a user, one needs to know the chain is unbroken and secure, but unless you are mining, you just need the tick that all is good, rather than every having to download the ledger and do your own mining.

Interestingly, Blockchain is thinking of splitting into multiple ledgers. As this has never been done before, it is seen as a vulnerable time when someone might mount an attack, thus many investors have been selling off. The expectation is that investors will buy bitcoins back once the ledger split has been (successfully) done. Ethereum is not looking at a split but they are considering compression and pruning as ways of reducing the ever growing ledger size.

Kalin Stoyanchev, Otoy’s blockchain expert comments that “Ethereum is just the backbone on which the actual transaction data (of The Render Token) is transferred but all the render work, all the job processing and all the work behind your render, is either ‘off chain’ (not on the blockchain) or done locally on your own computer, and then it gets sent”. There is no delays or mining problems. Ethereum was design to be the foundation for applications. “You don’t have to worry about the 70 Gigabytes – our application was built on top of the Ethereum Blockchain not within the Ethereum blockchain” he adds.

If The Render Token takes off, it will add to the growing ledger, but Stoyanchev points out these issues are already being dealt with by the original developers and “there are developing a bunch of new system that will tackle bloat, including sharding, which splits apart the blockchain and allows only that piece to be downloaded, for example, but that still connects to the decentralised ledger”.

Trust

Some projects require rendering only on certified render farms, with approved levels of security. The Render Token network can encompass this, as the system can have flags for the type of farm any user requests. If someone has spare capacity on an MPAA Certified farm, it can be offered at a premium. Each job can have different layers of security. “It will find the nodes on the system that are certified”, Urbach explains.

The system works without having unencrypted data sitting on a user’s hard drive. At the last stage of rendering, data is decoded as it is streamed onto the GPU. This makes it hard to hijack, but even here, AMD is in talks with the team to allow The Render Token to use the AMD’s TPP data encryption which is what is used on the XBox and Playstation4 (which has full custom computing encryption).

According to freeCodeCamp.org, in July, an unknown attacker exploited a critical flaw in the parity multi-signature wallet on the Ethereum network, draining three massive wallets of over $31,000,000 worth of Ether in a matter of minutes. Given a couple more hours, the hacker could’ve made off with over $180 million dollars worth of ether ($179,704,659 to be exact) from vulnerable wallets. But a team of ‘white hats’ stopped them.

This white-hat hackers team from the Ethereum community analyzed the attack and realized that there was no way to reverse the thefts, yet many more wallets were vulnerable. Time was of the essence, so according to freeCodeCamp, they hacked the remaining wallets before the attacker did.

The team parked the money in a set of new safe accounts and then later started giving the money back to their rightful owners when it was safe.

This was not a hacker(s) cracking the ledger or a flaw in the mathematical logic of blockchains. It was something far simpler. There are many different types of wallets. One of the most popular types is the multi-signature wallet. In a multi-signature wallet, there are several private keys that can unlock the wallet, but just one key is not enough to unlock it. If your multi-signature wallet has 3 keys, for example, you can specify that at least 2 of the 3 keys must be provided to successfully unlock it. This leads to much stronger security guarantees, so multi-sigs are a standard in wallet security. The very wallets themselves were how the hacker(s) cracked Ethereum.

So what went wrong?

According again to freeCodeCamp: The exploit was almost laughably simple: they found a programmer-introduced bug in the code that let them re-initialize the wallet, like restoring the wallet to factory settings. Once they did that, they were free to set themselves as the new owners, and then empty the wallets.

Such issues are a major issue for The Render Token. Otoy’s Alissa Grainger sees the attack this way: “this hack speaks to the complexity of the programming infrastructure of Ethereum and smart contracts in general. It is very tough to strike a balance between the intricacy and ability of the programming code and the overall security of the Solidity language.” she commented on behalf of the Otoy team. “The good news is that the leading developers in the blockchain community are highly skilled, able to adapt to the changing security environment within blockchain development and spread learnings across to others. The white-hat effort was remarkable and shows the commitment that the “good” players have to the rest of the community.”

What about China?

China has recently changed its policy on mining, the government has basically stated that it wants to stop Chinese companies from being set up to mine cryptocurrency. This has caused some real adjustments in the market, so much so that The Render Token postponed their sale from mid September to the start of October. While the price of all cryptocurrencies have dropped, it should be remembered that cryptocurrency are extremely volatile. Do not trade in cryptocurrencies unless you really know what you are doing (seriously don’t risk money you can’t afford to lose – there is no safety net here), for every case of someone making a fortune there are other stories of people being shocked by price drops.

Who’s behind Render Token?

There are some really interesting people in the Render Token group – both financially and as advisors, in addition to the Otoy co-founders such as Alissa Grainger and Jules Urbach. The team include people such as Ari Emanuel, the William Morris Endeavor co-CEO. Emanuel is known for his ‘brash’ style ( he is brother of Chicago Mayor Rahm Emanuel) – and said to be the real life ‘Ari’ that Jeremy Piven was able to capture so amazingly in Entourage.

The team also includes Lisa Randall, Professor of Science at Harvard University and specialist in theoretical physics, She is best known for working in particle physics and being a NY Times bestselling author. Also George Golder, founder and partner of Gilder Tech Fund and Brendan Eich the man behind the Brave Browser. The Brave Browser advertising model effectively uses an attention token system which avoids paid ads by having user’s attention logged. This system aims to completely rethink web ads and ad blocking and is called Basic Attention Tokens or BAT. The BAT system aims to improve the efficiency of digital advertising by creating a new token that can be exchanged between publishers, advertisers, and users. It also happens to run on the Ethereum blockchain. “Their team and approach around BAT was something we were able to leverage” commented Urbach. The BAT tokens can be used to obtain a variety of advertising and attention-based services on the Brave browser platform, currently in Beta.

Gas prices:(Deep Dive ~ feel free to ignore this postscript)

At the top of the story we stated that EVM was designed to be Turing-complete (ignoring gas limits)… just to unpack that, for those interested under the hood…

Ethereum smart contracts are called “Turing complete” (as in a ‘Turing machine’) as they are fully functional and can perform any computation that you can do in any other programming language. It may not be easy – but you can, just like you can make an Excel spreadsheet do almost anything – it is just very complicated using something like macros.

As we stated above, Ethereum uses Ether (ETH) not ‘bitcoins’. The value of Ether,, in say US$, changes all time, like any currency. But there is almost a second hidden currency in Ethereum, and it is call Gas.

Gas is the internal pricing for running a transaction or smart contract in Ethereum. Today it is about 1/100,000 ETH, or about US$0.003 but it has its own floating price. Think of gas as the unit of measure for computational use (or use of those ‘Excel Macro’ type smart contracts). If you want miners to run your smart contract, you offer a high Gas Price. In this way it’s a competitive auction driven by how much someone is willing to pay to have a contract run. Why even have Gas? It stops people from wastefully using smart contracts for something maybe like SPAM, which could happen if running smart contracts were free.

In Ethereum miners are free to ignore transactions whose gas price limit is too low. The gas price per transaction or contract is also set up to deal with the Turing Complete nature of Ethereum and its EVM – the idea being to limit infinite loops. So, for example, 0.00001 ETH or 1 Gas can execute a line of code or some command. If there is not enough Ether in the account to perform the transaction or program then it is considered invalid. This also stops denial of service attacks from infinite loops.

Thanks Mike, I’ve only just started trying to get my head around all of this, and this article is very clear and answer all of my questions that others have not. I’ll be keeping an eye on Render Token, it sounds fascinating.

Nice!

Whow – that escalated quickly ;)Great article on a quite complex issue. Its very rare nowadays to see online such indepth articles. Great Job.

Blockchain + AI + VR is the future! 🙂

Blockchain + Virtual Reality + Artificial Intelligence is the future! 🙂