With the Foundry deal having just finished, we visited the Foundry to discuss the new structure, what it might mean moving forward and how it will affect users. As we reported at the time, the Foundry was acquired by Roper Technologies, Inc, a diversified S&P 500 tech company.

At the time it was expected that the Foundry would remain an independent company, with Roper assuming ownership from the previous owners, Hg. The deal came as somewhat of a surprise to some, and we now know it was done much faster than had been expected.

We sat down with Craig Rodgerson, Foundry’s CEO, and Simon Robinson, Chief Scientist and original co-founder of the company, in their London offices to find out how the Foundry functions.

Rodgerson explained that four companies were in the running to buy the Foundry, as it moved from being a part of a private equity group to joining a strategic organisation. This was down from an initial seven companies who the Foundry initially spoke with just prior to Christmas. One of these four surprised everyone by offering a very key offer, but only if the deal was done immediately, or else it would be off the table. “In much the same way you might offer a strong bid on a property, to quickly close a deal,” Rodgerson explained. This immediately lead to counter offers and the deal closed weeks ahead of anyone’s best estimates. What appealed to Robinson is that Roper is a long term strategic investor and, “they have no stated short or medium term timeline to re-sell the company, notionally we could be with them forever,” he commented.

Roper has a successful history of acquiring well-run technology companies in niche markets that have strong, sustainable growth potential. Foundry’s track record of profitable growth and its leading position within its core markets made it an excellent fit for Roper’s long-term strategy. Rodgerson explains that Roper have two primary criteria for investing in a company:

- The company needs to be 1 or 2 in its market

- It has to be of a certain size

Roper itself is large in value and holdings but consists of just 47 people based in Florida. They invest in companies but don’t merge them. Their business model is built on maintaining the companies as separate units.

Rodgerson commented at the time of the announcement that the Foundry was “excited about the opportunities this partnership brings. Roper understands our strategy and chose to invest in us to help us realize our ambitious growth plans. This move will enable us to continue investing in what really matters to our customers: continued product improvement, R&D and technology innovation, and partnerships with global leaders in the industry.”

For the Foundry, they now have a very clear strategy for growth based on 4 key strategic aspects, beyond their core business:

- Expanding further into Asia, especially China,

- Extending further into Cloud solutions and virtual pipelines,

- Building their Design market segment, and

- Buying new key acquisitions.

Rodgerson pointed to China in particular as an example of how the new owners can really help, as the previous Hg owners had little experience in that market. “Don’t get me wrong, Hg was really supportive and good for the Foundry. In fact, I can’t think of a single thing I asked for that they didn’t give us,” he recalls. But compared to Roper, Hg had very little presence in China and Asia.

The Foundry has grown to a company with worldwide offices and over 300 staff. “I have seen the company grow inside an industry that started as a bit of a science experiment and it now operates in a mature industry,” commented Robinson. As such, the company wants to expand geographically, and by market segments, with an agenda that allows for growth through acquisition. We asked how that fitted with Roper’s stated goals of only buying companies that are 1 or 2 in a market, as this would theoretically exclude startups. Rodgerson pointed to Roper having an exception policy already, but it also seems that this approach is much more about Roper’s criteria for stand alone entities such as the Foundry itself, and would not apply to small teams what would become apart of the Foundry.

The new sale has not lead to any major staff changes, and no loss of independence for the management team. The Foundry is continuing to change internally with the move over recent times to a more rigid division between the Design team and the Media and Entertainment teams (M&E). The division internally, especially in development, had been much more fluid a few years ago, and now the two teams are most separately focused. M&E remains about 90% of the Foundry’s business and Robinson commented that the development team are very focused on advancing the M&E products, with new technology with a “simple focus of making the most perfect pixels,” he comments.

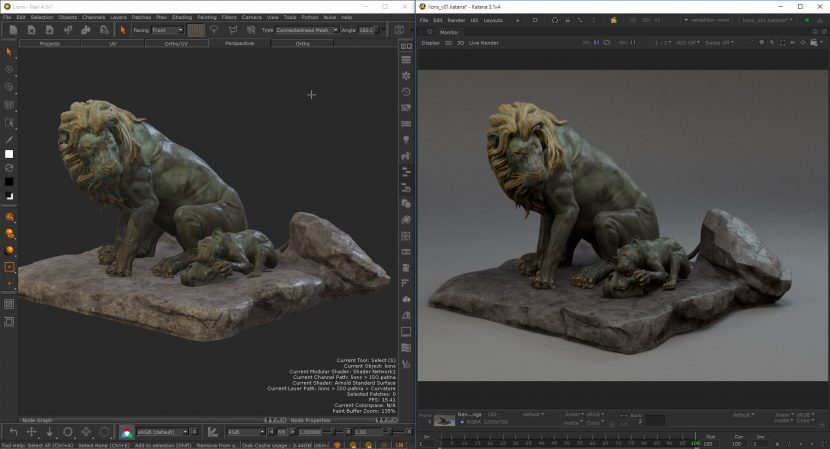

The Foundry has always had a long planning horizon, for example as the company points out now is really ‘Katana’s time’. The product is growing and making enormous advances, but it wasn’t always the case. Getting wide acceptance and adoption of Katana took some time. Currently there are some very significant advances in Nuke which we previewed and we will be exclusively highlighting in some depth in a future story, and Modo and the other products such as Mari, etc are all fully supported and moving forward.

The Foundry does have challenges, with customers often longing for the ‘good old days’ of knowing everyone in a small, dynamic, young company. Clients today often seek a host both for tiny improvements and bug fixes, as well as wanting landmark advances in technology. The Foundry has a dominant position in Compositing. Nuke is a powerhouse but as the very nature of M&E changes, Nuke is having to adapt also. As projects become much wider than just films and TV, Nuke is called on to do more and more. Robinson’s attitude is to build new tools for embryonic technologies, such as Light Fields, while still delivering hard core robust tools for traditional compositing, rig removal, keying and grading. The Foundry’s new technology group focused on new innovations with a planning timeline of 1.5 to 4 years. Both he and Rodgerson are aiming to balance these medium to longer term initiatives with the immediate concerns of a wide range of customers often carrying out their own cutting edge innovation and advances.

There is no doubt that any company acquisition consumes a management team. Between pitches and audits, such a process takes time and resources away from daily business. One gets the impression the Foundry is now very much freed up to implement their new strategy with both time and significant new resources.